What Is a Holding Company?

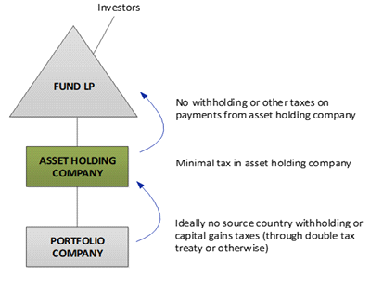

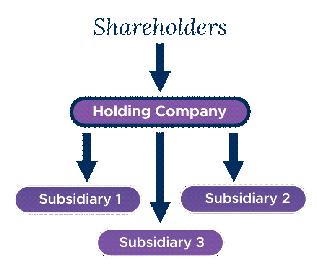

A holding company secures a controlling stake in another business and is often referred to as the parent company. Within the UK, holding companies generally concentrate on managing assets such as investments, property, and intellectual property, while also providing strategic direction. Typically, this setup requires ownership of more than 50% of another company’s shares, granting the holding company majority voting power and the authority to appoint or remove most board members.

Through a holding company, businesses can oversee and coordinate multiple subsidiaries, reduce overall risk exposure, safeguard assets, and potentially benefit from significant tax efficiencies. In certain cases, a holding company may fully own its subsidiaries—known as wholly owned subsidiaries—which it also has the ability to dissolve if needed.

If you are exploring the option of establishing a holding company to improve operational efficiency, our incorporation specialists are available to provide tailored guidance and support.